Russia is at present going through essentially the most punitive monetary measures and sanctions ever imposed on a rustic within the trendy monetary system.

The invasion of Ukraine has prompted a extreme political backlash and worldwide condemnation, mixed with an exclusion from markets that may, if it persists, have a vastly dangerous impact on the Russian financial system.

Whether or not President Putin sees the financial hardship as a worth price paying for the annexation of Ukraine stays to be seen.

And, in some unspecified time in the future, the cash to fund an invasion will turn into more durable to seek out.

Nonetheless, hypothesis apart, the monetary impact on Russia might be seen within the following charts.

Be aware: costs change rapidly, and these are at time of writing (February 28, approx 6am ET)

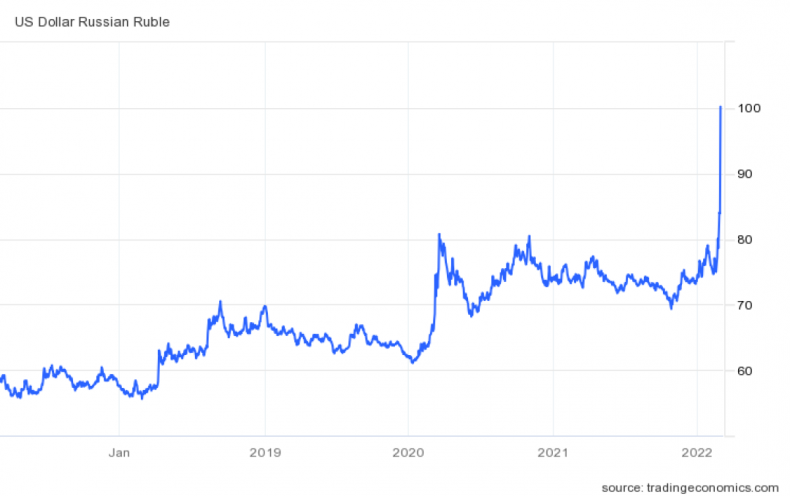

The Ruble

Russia's foreign money, the ruble, has crumbled in current days, shedding as much as 30 % of its worth in opposition to the greenback.

The foreign money is at present buying and selling at round R100 to $1, a file degree.

This presents an enormous downside for Russia when it comes to the value of imported items, and therefore inflation.

As costs feed by way of into the retailers, Russians will successfully need to pay far larger costs for any product that's both imported or depends on imports for its manufacture.

Curiosity Charges

One factor central banks have been historically in a position to do a couple of falling foreign money is elevate rates of interest.

This helps curb inflation and makes overseas funding extra engaging. Nonetheless, it is unlikely to assist both of these issues as buying and selling rubles is successfully out of the query for a lot of foreign money brokers.

In any case, as an excessive measure, the Russian Central Financial institution simply put rates of interest up from 9.5 % to twenty %.

Whether or not this can have any impact internationally is unclear. It might cease Russians taking their financial savings out of the banking system: there have been experiences of a run of withdrawals in Russia, and any financial institution run would trigger big issues domestically for Putin.

Financial institution of #Russia raises key fee to twenty% from 9.5% in emergency measure. Financial institution of Russia says exterior circumstances for the Russian financial system have drastically modified. Says fee hike is important to make ruble deposits engaging. (by way of BBG) pic.twitter.com/ivd8A2bN6k

— Holger Zschaepitz (@Schuldensuehner) February 28, 2022

Russian Sovereign Debt

Authorities debt is a great barometer of a rustic's monetary well being.

The yield on the 10-year Russia bond has risen to almost 13 %, and an increase in yields reveals the worth of the bond, and the religion in traders of the nation paying again the debt, has fallen.

That is the best degree since 2015, and is a pointy improve from the beginning of 2022 when the yield was lower than six %.

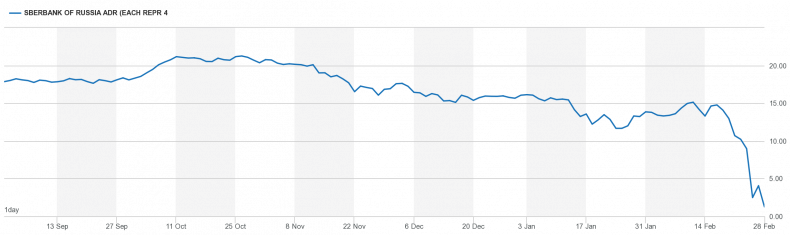

Sberbank

Russia's state-owned Sberbank is a key a part of the monetary system in Russia, with worldwide and home prospects. In accordance with Statista, it's the largest Russian financial institution by property, almost twice the scale of the following, VTB.

And its shares (when it comes to ADRs, or American Depositary Receipts, negotiable securities issued by a financial institution) in London simply almost hit zero.

The European Central Financial institution has warned that Sberbank's European arm might fail, and be unable to pay its money owed. This in fact can harm different banks within the system too: non-Russian banks which have money owed, or different relations with Russian banks.

However, the collateral monetary injury in Europe shall be nothing in comparison with the headache that the failure of the state financial institution would give the Kremlin.

Moscow Trade

The general Moscow inventory trade index, the MOEX, has seen a tough few days.

Over $150 billion was worn out in buying and selling on Thursday final week. The worth of corporations in the marketplace is being hit by investor worries over sanctions, incapacity to commerce, and a doable recession in Russia.

Bitcoin

Should you can commerce rubles for dollars, the place else do you go? One reply is cryptocurrency.

Ruble-denominted bitcoin trades have surged in current days, with volumes over 1.5 billion, based on Coindesk.

Bitcoin-ruble buying and selling volumes surged because the West's sanctions on Moscow triggered a flight to security away from the ruble. experiences @godbole17https://t.co/pw8XHHQIPv

— CoinDesk (@CoinDesk) February 28, 2022

What About Oil?

Newsweek has not put the oil worth or worth of pure fuel on this record because it debatable to what extent Russia will be capable of proceed buying and selling these commodities.

Actually, larger costs ought to assist Russia, given that it's the world's second largest oil exporter, however with Russian monetary establishments barred from utilizing the SWIFT cost system there shall be main disruption.

In accordance with Reuters, oil and commodities merchants have mentioned flows of Russian commodities to the West shall be severely disrupted or completely halted for days, if not weeks, till some readability is established on cost exemptions.

Post a Comment