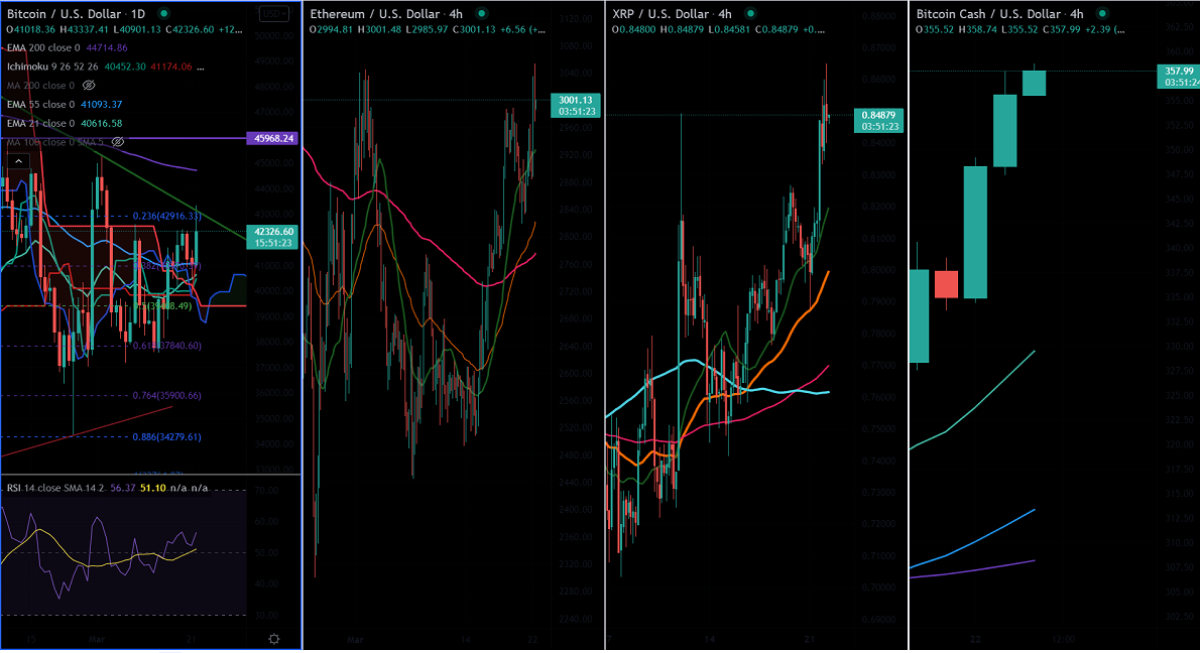

Bitcoin (BTC/USD) Evaluation

Key Highlights

Bitcoin began the brand new week with constructive momentum after the Fed Chairman's feedback. It has struggled to shut above the symmetric triangle ($43,300).

Over 480,000 new Bitcoin addresses had been created on March 17 – a robust surge which may see additional upside.

Technical Evaluation

Intraday development - Bullish

On the each day chart, the pair is buying and selling above Tenken-sen ($39,986), Kijun-sen ($39,828), and above Ichimoku Kumo cloud ($40,238). It hits a excessive of $43,337 on the time of writing and is at present buying and selling round $42,239.

Main assist is seen at $40,445, any drop beneath this stage would affirm a minor weak spot. A dip until $37,000 (Mar seventh low)/$34,000/$32,950 (Jan twenty fourth low)/$30,000/$28,600 is probably going.

The fast resistance is round $43,300, any each day shut above that stage confirms additional bullishness. A bounce to $45,356 (200-day EMA)/$50,000 is feasible.

RSI - bullish

A potential technique may very well be a protracted on dips $41,480-500 with SL round $39,000 for TP of $50,000.

ETH/USD Every day Outlook

Key Highlights

ETH/USD jumped to $3,053 following the footsteps of Bitcoin. It's at present buying and selling round $2,990.70.

On the each day chart, the pair is buying and selling above Tenken-sen ($27,40.95), Kijun-sen ($2,672), and barely beneath Ichimoku Kumo cloud ($3,026).

Main assist is seen at $2,800, any drop beneath this stage confirms the bearish development. A dip until $2,740/ $2,670/$2,600/$2,500/$2,445/$2,300 (Feb twenty fourth low)/$2,150 is feasible.

The fast resistance is round $3,026; any shut above targets of $3,300/$3,512 are potential.

RSI - Impartial

A potential technique may very well be a protracted round $2,925-30 with SL round $2,800 for TP of $3,500.

XRP/USD Outlook

Intraday development - Bullish

Key assist - $0.70, $0.50

Key Resistance - $0.865 (Mar twelfth 2022)

XRP'S worth is holding above short-term (55-day EMA) and long-term (200- day EMA) on the each day chart. Any breach above $0.8650 confirms a bullish continuation; it's at present buying and selling round $0.8488. Search for a short-term development reversal provided that it breaches $1.02 (twenty third Dec excessive).

A probable possibility can be to purchase above $0.860 with SL round $0.80 for a TP of $1.02.

BCH/USD Outlook

Intraday development - Bullish

Key assist - $300, $259

Key Resistance - $363

BCH/USD's worth holds above short-term (55-day EMA) and long-term (100- day EMA) on the each day chart. Any escape above $363 confirms additional bullishness - it's at present buying and selling round $355.58. Search for a short-term development reversal provided that it breaks $430.

A potential possibility can be lengthy round $320 with SL round $270 for a TP of $395/$429.

Bitcoin Help /Resistance

R1- $43,300, R2- $46,000, R3- $50,000

S1- $37,000, S2- $34,000, S3- $30,000

Ethereum Help/Resistance

Resistance

R1- $3,030, R2- $3,200, R3- $3,300

Help

S1- $2 740, S2- $2,670, S3- $2,600

See extra on the Newsweek Cryptocurrency Index:

Disclaimer: The above evaluation is just for market data functions. Newsweek doesn't provide any advisory or brokerage providers, nor does it suggest or advise traders or merchants to purchase or promote specific shares, securities or different fundings.

Post a Comment