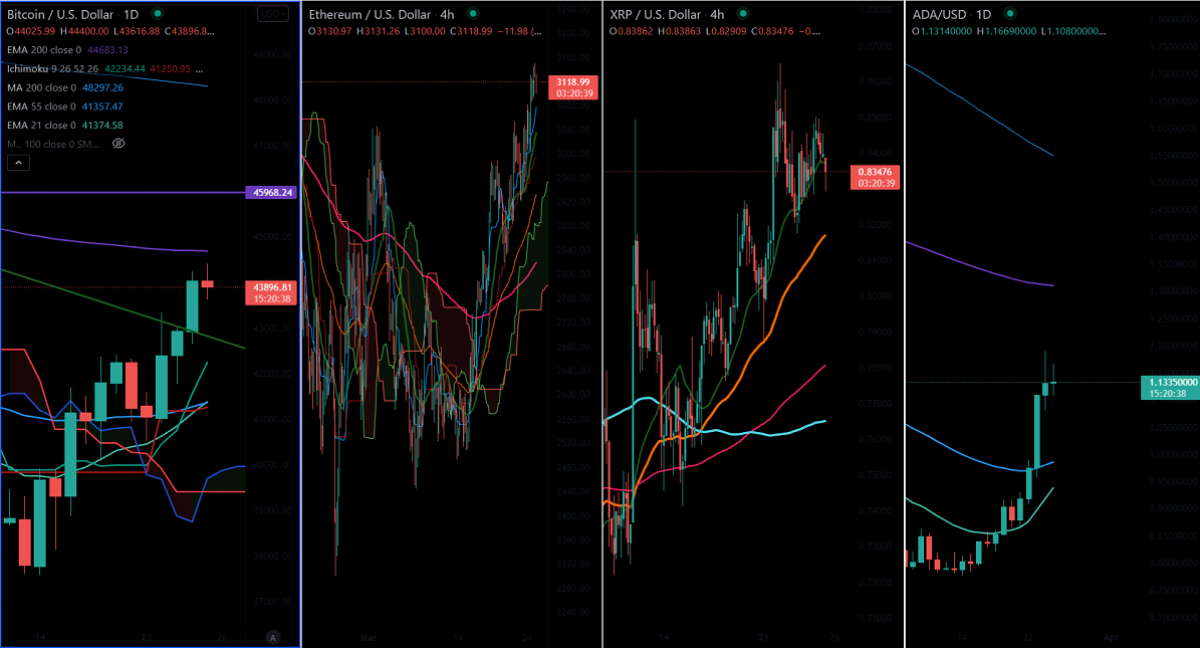

Bitcoin (BTC/USD) Evaluation

Key Highlights

BTC trades greater for the third consecutive day and hits the best stage since Mar third. The pair gained sharply after information that Russia might settle for Bitcoin for oil and fuel funds. It's holding above the symmetric triangle which reveals that BTC is predicted to the touch $45,850 (Feb tenth excessive).

Technical Evaluation

Intraday development - Bullish

On the day by day chart, the pair is buying and selling above Tenken-sen ($41,552), Kijun-sen ($41,174), and Ichimoku Kumo cloud ($39,400). It hit an intraday excessive of $44,400 and is at the moment buying and selling round $44,062.

Main assist is seen at $43,500, any violation under this stage confirms intraday bearishness. A dip until $42,500/$41,700/$41,000/$40,450/$39,000/$37,000 (Mar seventh low) is feasible.

The quick resistance is seen round $45,000 - any surge previous targets $46,000. Main bullishness can occur provided that it breaks $46,000; at that time an increase to $50,000/$52,000 is probably going.

RSI - Bullish

A potential technique could possibly be lengthy on dips $43,500 with SL round $42,500 for TP of $50,000.

ETH/USD Day by day Outlook

Key Highlights

Ethereum costs hit a contemporary one-month excessive and closed above $3,000 for the primary time since Feb seventeenth. It hit an intraday excessive of $3,149.80 and is at the moment buying and selling round $3,145.

On the day by day chart, the pair is buying and selling above Tenken-sen ($2,867), Kijun-sen ($2,787), and Ichimoku Kumo cloud ($2,789).

Main assist is seen at $3,000, any violation under this stage confirms intraday bearishness. A dip until $2,940/$2,880/$2,800/$2,740/ $2,670/$2,600 is probably going.

The quick resistance is round $3,199 (Feb fifteenth excessive), any break above targets of $3,300/$3,512 is feasible.

RSI - Bullish

A potential possibility could possibly be lengthy on dips round $3,100 with SL round $2,940 for TP of $3,500.

XRP/USD Outlook

Intraday development - Bullish

Key assist - $0.70, $0.50

Key Resistance - $0.865 (Mar twelfth 2022)

XRP's worth has been consolidating in a slender vary between $0.8650 and $0.81750 for the previous 4 days. Any leap above $0.8650 confirms a bullish continuation, it's at the moment buying and selling round $0.84111, short-term development reversal provided that it breaches $1.02 (the twenty third Dec excessive).

A potential technique could possibly be purchase above $0.860 with SL round $0.80 for a TP of $1.02.

ADA/USD Outlook

Intraday development - Bullish

Key assist - $0.95, $0.80

Key Resistance - $1.30

ADA/USD confirmed a minor revenue reserving after hitting a current 6 week excessive. Any breach above $1.20 confirms additional bullishness, it's at the moment buying and selling round $1.145. Quick-term development reversal provided that it breaks $1.57.

A potential possibility could possibly be lengthy round $1.078-80 with SL round $0.95 for a TP of $1.570.

Bitcoin Help /Resistance

Resistance

R1- $46,000, R2- $50,000, R3- $52,000

Help

S1- $43,500,S2- $42,500,S3- $41,000

Ethereum Help/Resistance

Resistance

R1- $3,200, R2- $3,300, R3- $3,500

Help

S1- $3,000, S2- $2,820, S3- $2,740

See extra on the Newsweek Cryptocurrency Index:

The content material of this text is for informational functions solely and doesn't represent monetary or funding recommendation. It is necessary to carry out your individual analysis and take into account searching for recommendation from an impartial monetary skilled earlier than making any funding selections.

Post a Comment