Plenty of folks within the so-called "boomer" era have hit out at President Joe Biden's reported plans to forgive some scholar mortgage debt for thousands and thousands of individuals.

The suggestion that Biden could comply with by means of with one in every of his 2020 marketing campaign guarantees was revealed by California rep. Rep. Tony Cardenas, following a gathering the president had with the Congressional Hispanic Caucus.

Throughout the assembly, Biden is reported to have stated he's not solely ready to increase the present federal moratorium when it expires in August, however can be trying into forgiving at the very least $10,000 in debt for college students who're paying again their loans.

"He stated, 'Sure, I am exploring doing one thing on that entrance,'" Cardenas instructed the Related Press. "And he additionally smiled and stated, 'You are going to like what I do on that as nicely.'"

The transfer to cancel scholar debt has been lengthy referred to as for by the progressive sections of the Democratic occasion. It's seen as a approach for Biden to enhance his scores within the polls and possibilities of profitable the following election, in addition to assist the Democrats retain management of the Home and Senate following November's midterms.

Nevertheless, the reported plans to forgive scholar loans cash have additionally been met with criticism, particularly from older generations who've spent years paying off their very own debt.

Others additionally take problem that individuals who didn't attend faculty should cowl the fee for many who attended costly colleges.

"Canceling scholar debt is unfair to thousands and thousands who labored exhausting to repay their very own," tweeted Fox Information character Geraldo Rivera.

"The Rep. Ro Khanna concept works higher for people and the nation: Free Neighborhood Faculty for each American highschool grad. No Debt, only a leg up for each child wealthy, poor or center class."

Mark Curtis, an tv anchor for Arizona's 12 Information, added: "Cancelling accrued curiosity on a mortgage.. I can see or reducing rates of interest to 0%... however forgiving ALL scholar mortgage debt? Whereas good.. it's unrealistic and unfair to all of those that have labored their tails off prior to now."

Utah Republican Senator Mitt Romney mocked the plans to wipe off scholar mortgage debt as "determined" from Biden.

"Determined polls name for determined measures: Dems think about forgiving trillions in scholar loans," Romney tweeted. "Different bribe solutions: Forgive auto loans? Forgive bank card debt? Forgive mortgages? And put a wealth tax on the super-rich to pay for all of it. What might presumably go mistaken?"

Mississippi Governor Tate Reeves, who at aged 47 just isn't a part of the boomer era, additionally tweeted his objection to the scholar mortgage forgiveness concept on the idea it have an effect on those that didn't attend faculty

"Mississippians with out faculty levels (or who paid off their debt) shouldn't be pressured to pay for the scholar loans of others," Reeves tweeted. "Why ought to individuals who selected to not go to school or selected to settle their very own loans be punished for the advantage of those that made completely different choices?

"The scholar mortgage machine is predatory. It ought to be held accountable. However this can be a essentially unfair and unwise approach for the Biden administration to do it."

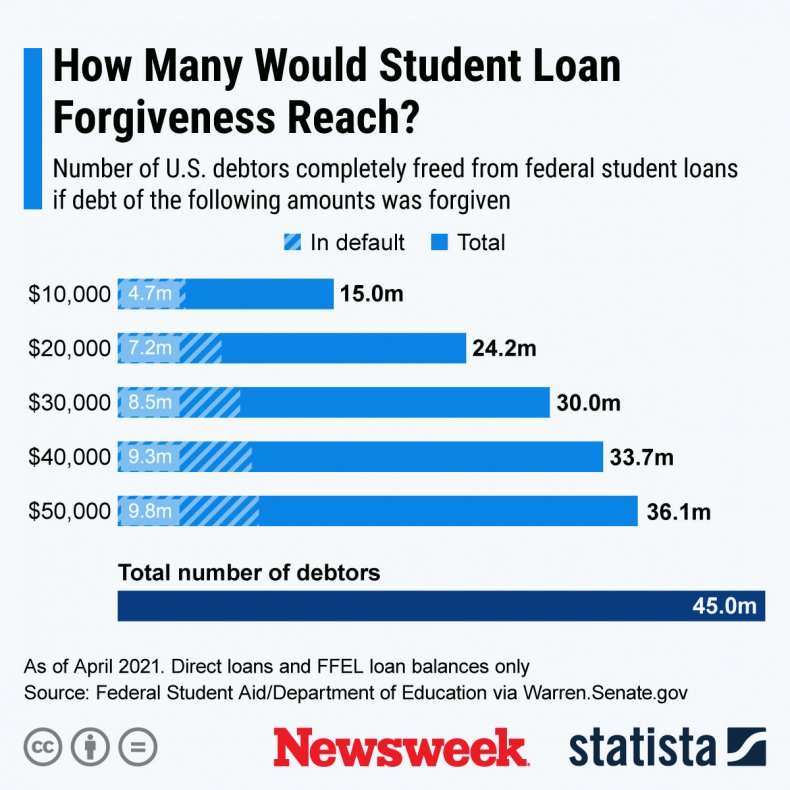

This graph, supplied by Statista, exhibits the impression scholar mortgage forgiveness would have.

The difficulty on whether or not scholar loans ought to be forgiven has proven to be extra favorable with millennials—these born between 1981 and the mid 90s—and Technology Z, these at the moment aged round 24 and below.

In response to a Morning Seek the advice of ballot in December, there's a main gulf by way of approval between age demographics when requested if the federal government ought to enact some kind of scholar mortgage reduction.

The survey discovered that 45 p.c of child boomers, these at the moment aged between their mid 50s and mid 70s, are towards any type of scholar mortgage forgiveness.

One in 10 boomers stated all scholar loans ought to be wiped off for households with decrease incomes, with simply 9 p.c stating all scholar money owed ought to be forgiven.

Compared, multiple third (34 p.c) of millennials imagine that each one scholar loans ought to be forgiven, with simply 13 p.c believing no loans ought to be wiped off.

Almost one quarter (24 p.c) of Gen Z, a few of whom won't have began paying again any faculty loans but, stated the money owed be forgiven totally.

In addition to there being opposing views amongst completely different age teams, there's additionally a partisan break up over the suggestion of scholar mortgage forgiveness.

In response to the Morning Seek the advice of ballot, 51 p.c of Democrats imagine there ought to be some type of scholar mortgage forgiveness, whereas practically half (48 p.c) of Republicans stating there ought to be none in any respect.

The White Home has been contacted for remark.

Post a Comment