It appears like a type of too-good-to-be true propositions: Purchase an merchandise on-line, shell out only a fraction of the value at checkout and pay the rest in installments over time, sometimes at no additional price. As on-line buying has soared through the pandemic, the recognition of those new fee packages, often called purchase now, pay later (BNPL) plans, has skyrocketed as effectively. Final 12 months alone, Individuals spent $20.8 billion by means of these companies, with purchases total up 230 % because the begin of 2020, in keeping with a examine by Accenture commissioned by Afterpay, one of many main gamers within the area.

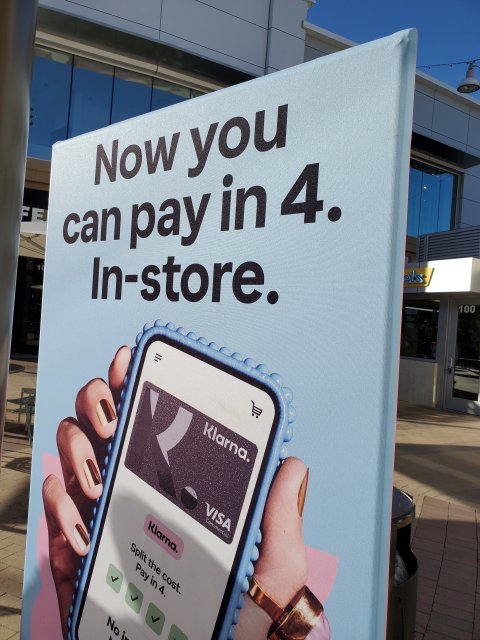

Historically provided only for on-line spending by monetary tech firms like Affirm, Klarna and PayPay Credit score along with Afterpay, the forms of BNPL plans accessible and the businesses that present them has grown sharply. Now the plans have been prolonged to incorporate some in-store purchases too, and credit-card issuers are moving into the act as effectively, providing their very own variations of installment fee plans. In different phrases, they're in all places today. Whereas estimates of use vary extensively, the consensus means that between a minimum of one-third to one-half of Individuals have used an prolonged fee plan a minimum of as soon as and that roughly three-quarters of them are repeat prospects.

The enchantment is comprehensible: Along with the sometimes free financing, the applying course of is straightforward, with barely any credit score verify concerned, and approval is almost instantaneous. However there are dangers too, they usually're typically not understood by shoppers. They embody late charges that may pile up, doable injury to credit score scores, an absence of the normal oversight that governs different forms of loans, and a few consumers being lured into spending greater than they'll afford. These dangers had been thought of critical sufficient by the Shopper Monetary Safety Bureau that the watchdog company not too long ago launched an inquiry into the enterprise practices of the 5 main BNPL suppliers. The three main credit score bureaus additionally introduced adjustments on the finish of final 12 months to raised monitor utilization of those packages.

Occupied with making the most of the supply to increase funds—totally free!—in your subsequent on-line buy? Here is what it's worthwhile to know earlier than you click on sure.

How the Plans Work

Purchase now, pay later packages fall into one in all two broad classes, normally relying on the value of what you are buying. For gadgets that price $1,500 or much less, the plan sometimes splits compensation into 4 equal installments unfold throughout six weeks; you will not be charged curiosity and the mortgage will not affect your credit score file or rating. For bigger purchases, funds are normally unfold over an extended interval, as much as 48 months, and you may most likely be charged curiosity that may run as excessive as 30 %, relying in your private profile and credit score historical past.

The identical firms typically supply each plan varieties and the method is similar. You apply at checkout for credit score that covers the quantity of your buy (versus, say, a bigger line of credit score on an ordinary bank card). You reply a couple of fundamental questions on your self, resembling your date of start, e mail handle and telephone quantity, present a debit or bank card quantity, after which, voila, you are accredited (bigger loans may require a credit score verify). You pay a portion of the invoice while you purchase and the remaining steadiness in equal installments over a hard and fast interval. If it is a bigger-ticket merchandise and the plan fees curiosity, that extra price might be baked into every fee and spelled out earlier than you settle for the mortgage.

"It's a quick, painless course of. You enter as little as 4 items of details about your self and inside 30 seconds discover out in case you're accredited," says Ginger Schmeltzer, strategic advisor for Aite-Novarica Group's retail banking and funds apply.

Desire in-store buying to digital offers? Not an issue. Some companies now supply an identical prolonged fee plan by way of debit playing cards or digital playing cards you possibly can entry by means of their apps. Amex, Chase and different conventional bank card issuers have begun providing cardholders the choice of an identical installment plan for some giant purchases, sometimes for a hard and fast payment—prone to chase away the competitors since greater than half of BNPL plan customers want them to bank cards and 38 % say they intend to switch their plastic with them, C+R Analysis experiences.

A part of the plans' enchantment is the truth that shoppers see them as a extra clear type of borrowing than paying by bank card, with a hard and fast quantity due every fee interval and a deadline for settling the debt, which makes it simpler to price range, says Matt Schulz, chief credit score analyst at LendingTree. Buyers with skinny or poor credit score histories or maxed-out playing cards additionally want these companies as a result of they've a greater likelihood of approval. In keeping with CB Insights, as an illustration, Affirm approves 20 % extra prospects on common than comparable opponents.

The benefit of the purchase now, pay later course of shortly makes converts out of its customers. Nearly half say they now select this financing methodology more often than not or each time they store on-line, in keeping with C+R Analysis.

Customers Are Confused

And therein lies a part of the issue. Purchase now, pay later plans make it really easy to finance a purchase order that many patrons join with out actually realizing what they're moving into—one purpose that the federal authorities shopper watchdog company is wanting into them. "The Bureau is conscious of shopper demand for purchase now, pay later credit score and its substantial development over 2020 and 2021," the CFPB tells Newsweek. "This development, mixed with considerations about potential shopper misunderstanding of the merchandise, and the dearth of high quality publicly accessible information on the BNPL market, led the Bureau to challenge its market monitoring inquiry."

Among the many misconceptions: Many shoppers do not realize BNPL plans are a type of credit score or a mortgage. As an alternative, folks describe them as a "technique to pay" or a "cash administration instrument," and 1 / 4 of customers incorrectly instructed The Motley Idiot BNPL plans aren't debt.

Since these companies are comparatively new and every BNPL supplier has its personal distinctive compensation phrases and schedule, shoppers can get blended up. Almost a 3rd of customers instructed LendingTree they did not know what the rate of interest and charges could be earlier than financing a purchase order with one of many companies. And solely a few third instructed The Motley Idiot they perceive BNPL very effectively.

"Individuals do not all the time know what the monetary dangers are," says Kathleen Blum, vice chairman of customer insights for C+R Analysis. "They don't seem to be taking note of the effective print phrases as a result of they do not suppose they will ever have to or as a result of they do not plan on lacking a compensation."

Overspending Ache

The simplicity of the applying and approval course of, although, makes it simple for shoppers to get in over their heads. Since lots of the companies don't verify your credit score file, there are few safeguards on the subject of whether or not you possibly can actually afford to repay the mortgage, given different payments and money owed it's important to pay.

"Whereas the old-style layaway installment loans had been sometimes used for the occasional large buy, folks can shortly change into common customers of BNPL for on a regular basis discretionary shopping for," the CFBP mentioned in saying its investigation. "If a shopper has a number of purchases on a number of schedules with a number of firms, it might be arduous to maintain monitor of when funds are scheduled."

In actual fact, virtually six in 10 BNPL customers instructed C+R Analysis that they regretted a purchase order as a result of the merchandise was too costly. And a 3rd say they've missed a minimum of one fee, in keeping with Credit score Karma.

Fail to pay on time and plenty of suppliers cost late charges. Klarna has a $7 payment per missed fee, whereas Zip takes $5 to $10, relying in your state. Even when borrowing with firms like Affirm and PayPal, which do not have such charges, lacking funds can nonetheless injury your credit score rating in the event that they report the unpaid mortgage to debt collectors and credit score bureaus and have an effect on your means to get one other mortgage. Credit score Karma discovered that 72 % of people that paid late noticed their credit score scores drop.

Whereas nearly all of customers pay again their loans on time, BNPL does push folks to spend extra, in comparison with different types of fee. When a retailer gives a BNPL possibility, analysis from Aite-Novarica Group discovered, the typical invoice jumps 40 %.

The reason being partly psychological. When transactions are damaged down into 4 or extra small funds as these companies do, shoppers trick themselves into pondering they're spending much less. You already know the sneakers price $150, for instance, however as a result of the invoice says $37.50, you rationalize that you simply solely must shell out that a lot for now.

"These plans delay the current price of the gadgets we're shopping for. Future losses all the time appear much less scary than present ones and we all the time suppose we'll be higher off tomorrow," says Carrie Rattle, a monetary therapist who focuses on overshopping. "They play on shoppers' overconfidence sooner or later and the sensation that we've got the power to manage the scenario

as a result of the fee looks as if a small quantity."

One key distinction between bank cards and BNPL plans that does assist curtail debt accumulation: When shoppers fail to make a fee or repay in full, they can't use the service once more till they achieve this. That mentioned, as a result of many firms do not do credit score checks or share information with different lenders, shoppers can merely flip to different BNPL firms for brand new credit score after which have a number of of those loans excellent concurrently.

"Whenever you're utilizing BNPL for smaller purchases and doing so quite a bit, it might probably change into a hazard," says Blum.

Impression on Credit score Scores

Now that BNPL plans have gone mainstream, credit score bureaus need this mortgage data higher mirrored in credit score experiences and are actively engaged on bringing that about. Equifax, as an illustration, introduced in December, that it could standardize a course of for reporting these loans and start including such information to shoppers' credit score recordsdata possible this spring. The opposite two main credit score bureaus, Experian and TransUnion, have additionally mentioned they are going to be including extra BNPL information to their credit score experiences.

Equifax claims this can assist lenders higher resolve whether or not to open new traces of credit score to prospects, whereas additionally rewarding BNPL customers for his or her good compensation historical past—a change that might increase folks's FICO credit score rating, on common, 13 factors to 21 factors.

"Proper now your credit score is just not actually impacted by BNPL plans, except you miss a fee or your debt is shipped to collections," says Francis Creighton, president and CEO of the Shopper Knowledge Trade Affiliation. "We expect that is problematic. In case you do pay on time nothing is reported. You get not one of the upsides of repaying and appropriately utilizing these loans."

Credit score scoring fashions, like these operated by FICO and VantageScore, may even want to regulate, on condition that the present components penalizes shoppers for having a number of new credit score inquiries in a brief span of time and rewards longer loan-terms.

"In case you use BNPL companies, you may need seven loans at anyone time. To conventional credit score reporting, this seems to be like seven new mortgage functions however actually it's extra akin to seven fees on a bank card," says Creighton. "We'd like to verify that is adjusted appropriately so folks utilizing the product as designed do not get dinged for doing every part proper."

Purchase Properly

Purchase now, pay later plans could be a nice monetary instrument that can assist you afford crucial, however higher-cost gadgets, particularly in case you nab a zero % rate of interest supply. And with guidelines surrounding how credit score bureaus deal with these loans altering, they may also be a sensible technique to construct your credit score historical past with much less threat within the close to future.

Nonetheless, as with all types of borrowing, it is very important be sure to know the total phrases of the mortgage earlier than agreeing and really feel snug assembly the required funds in gentle of your different ongoing bills, like lease, mortgage funds or pupil mortgage payments.

As a result of BNPL funds observe their very own schedule that commences on the day of your buy, arrange automated funds and conform to obtain reminders about upcoming payments. That approach you will not must maintain monitor of a number of repayments. Simply ensure you have got sufficient in your account when these companies take an automated fee or you may be hit with a $35 overdraft payment out of your financial institution.

In case you're struggling to make a fee, name the lender earlier than the due date to debate doable options. Some companies could enable you a grace interval of a few days to earlier than assessing the late payment, provide the possibility to increase or change the fee date, or supply hardship packages, in case you, say, lose your job or expertise a pure catastrophe.

Lastly, specialists warning that in case you plan to spend so much, or may have to return gadgets, swipe the bank card as a substitute. Your plastic comes with stronger shopper protections than BNPL plans, on the subject of disputed fees and should supply buy safety if gadgets are broken or stolen, in keeping with the CFPB. Says the company: "Returning merchandise purchased with BNPL can generally be difficult." And who today wants difficult?

Post a Comment