Welcome to Newsweek's cryptocurrency information: on this each day replace we might be wanting on the motion and outlook for main cryptocurrencies, together with Bitcoin, with a technical evaluation.

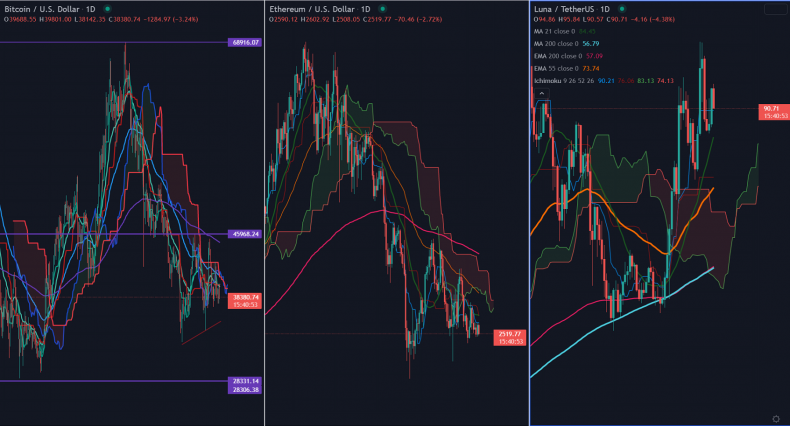

Bitcoin (BTC/USD) Outlook

Key Highlights

Bitcoin has been buying and selling in a decent vary between $45,338 and $34,325 for the previous three weeks because of geopolitical tensions. Buyers are on the lookout for protected haven belongings, and hypothesis whether or not bitcoin can be utilized as a car to evade Russia sanctions.

BTC may achieve momentum if it breaks $40,000. For the time being, markets are additionally ready for US Federal Reserve financial coverage choice for additional course: the rate of interest assembly choice is on Wednesday.

Technical Evaluation

Intraday development: Bearish

Within the each day chart, the pair is buying and selling under Tenken-sen ($39,880), Kijun-sen ($39,828), and Ichimoku Kumo cloud ($41,184) confirming the minor weak development. There's a low of $38,645 and BTC is at the moment buying and selling round $38,761.

Main assist may kick in for BTC at $37,000 (the low on March seventh): a drop under this stage would affirm a continuation of the bearish outlook. That might imply a dip till $34,000/$32,950 (the Jan twenty fourth low) or $30,000/$28,600.

Intraday development reversal might occur if Bitcoin closes above $40,000. A soar to $42,600 (the Mar ninth excessive)/$45,356 (200-day EMA)/$50,000 is feasible.

RSI: impartial

Sign: It could be good to purchase above $40,000 with SL round $37,000 for TP of $50,000.

Ethereum (ETH/USD) Outlook

Key Highlights

ETH/USD is buying and selling weakly for the third consecutive day, as demand for riskier belongings declined because of Russia-Ukraine battle.

Technical Evaluation

Within the each day chart, the pair is buying and selling under Tenken-sen ($2,609), Kijun-sen ($2,731), and Ichimoku Kumo cloud ($2,889) confirming the minor weak development. Ethereum hit a low of $2,537 on the time of writing and is at the moment buying and selling round $2,544.

Main assist is seen at $2,445, any violation under this stage confirms bearish continuation. A dip till $2,300 (Feb twenty fourth low)/$2,150 is feasible.

Intraday development reversal might occur if Ethereum closes above $2,610. A soar to $2,774/$2,850/$3,000 is feasible. A bullish continuation is above $3,300 solely.

RSI: Impartial

Sign- It could be good to purchase above $2,610 with SL round $2,445 for TP of $3,300.

XRP/USD

Intraday development: Bearish

Key assist: $0.70, $0.50

Key Resistance: $0.86 (Mar twelfth 2022)

XRP's worth has held under short-term (55-day EMA) and long-term (200- day EMA) averages. Any breach under $0.70 would affirm additional bearishness. It's at the moment buying and selling round $0.7500. The could also be a short-term development reversal provided that it breaches $1.02.

Sign: It could be good to promote under $0.70 with SL round $0.80 for TP of $0.50.

LUNA/USD

Intraday development: Bullish

Key assist: $89, $75

Key Resistance: $105

LUNA/USD's worth is holding above short-term (55-day EMA) and long-term (200- day EMA) averages. Any breach above $105 would present additional bullishness. It's at the moment buying and selling round $92.20. Quick-term development reversal provided that it breaks $75.

Sign: It could be good to purchase on dips round $85 with SL round $75 for TP of $130.

Bitcoin Assist /Resistance Pivot Factors

Resistance

R1- $40,250

R2- $43,500

R3- $46,000

Assist

S1- $34,000

S2- $30,000

S3- $28,600

Ethereum Assist/Resistance

Resistance

R1- $2,750

R2- $2,850

R3- $3,160

Assist

S1- $2,445

S2- $2,300

S3- $2,150

See extra on the Newsweek Cryptocurrency Index:

Glossary

SL: Cease-loss is an advance order to promote an asset when it reaches a specific worth level. It's used to restrict loss or achieve in a commerce.

TP: A Take Revenue is an instruction to shut a commerce at a particular price if the market rises.

EMA: An exponential shifting common. It is a kind of shifting common (MA) that locations a higher weight and significance on the newest knowledge factors. The exponential shifting common can be known as the exponentially weighted shifting common.

BTC: the buying and selling acronym for Bitcoin

Tenkan-Sen (or Conversion Line): the mid-point of the very best and lowest costs of an asset during the last 9 intervals.

Kijun-sen: the midpoint worth of the final 26-periods. It's an indicator of short- to medium-term worth momentum.

Ichimoku Cloud: a set of technical indicators that present assist and resistance ranges, in addition to momentum and development course. It can be used to forecast the place the value might discover assist or resistance sooner or later.

Main assist and resistance areas: worth ranges which have not too long ago precipitated a development reversal. If the value of an asset is trending increased after which reverses right into a downtrend, the value the place the reversal began known as a robust resistance stage. The place a downtrend ends and an uptrend begins is a robust assist stage.

Pivot factors of resistance:

A technique to determine assist and resistance ranges:

Pivot Level (P) = (Earlier Excessive + Earlier Low + Earlier Shut)/3

Assist 1 (S1) = (Pivot Level x 2) - Earlier Excessive

Assist 2 (S2) = Pivot Level - (Earlier Excessive - Earlier Low)

Resistance 1 (R1) = (Pivot Level x 2) - Earlier Low

Resistance 2 (R2) = Pivot Level + (Earlier Excessive - Earlier Low)

When it comes to investing into a digital currency, what's the best crypto for beginners? The popularity of crypto continues Stocks, Commodities, ETFs apace with more 'everyday investors' – many of them complete novices - enjoying the benefits and rewards.

ReplyDeletePost a Comment